All you need to know about importing DETALE products from the EU

DETALE has worked with the UK market for many years, and since the UK pulled out of European Customs union in 2021, DETALE has adapted to meet the new Customs and VAT declaration requirements, to enable an easy and reliable purchase experience for all our UK clients.

Even though the new regulations were implemented a few years ago, we still receive questions from our clients. Below we try to answer some of the most frequently asked questions related to the Customs and VAT requirements in the UK.

What is a VAT number?

A VAT number is a registration number which identifies a taxable business or a non-taxable legal entity that is registered for VAT. The VAT registration number identifies the tax status of the customer, the place of taxation and is necessary when claiming back VAT from UK customs.

How do we distinguish between B2B and B2C?

B2B (business-to-business), is the exchange of products between two companies with valid VAT numbers. and where a transaction is conducted between two businesses.

B2C (business-to-consumer) is the exchange of products between one company and one private person and where the transaction takes place between a business and an individual as the end customer.

Will my order include VAT?

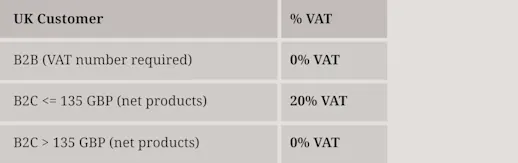

A B2C customer pays 20% VAT on all orders below 135 GBP, when purchasing products online.

If a B2B customer has a valid VAT number, 0% VAT will always apply, upon registration of the VAT number through check out. If the client does not register a VAT number in checkout, the client is registered as a B2C regarding VAT and customs declarations.

Will I be charged VAT locally?

The B2C customer is responsible for paying VAT locally for all purchases above £135 once the product arrives in the UK.

All VAT registered businesses (B2B) in the UK will pay VAT at the border. You will need your invoice of the purchased products to pay and refund VAT.

Delivery and returns

On all orders with a net value below 135 GBP, 20% VAT will be included in your cart, and your products will be delivered to the UK within 5-7 business days.

On all orders with a net value above 135 GBP, VAT will be calculated by local customs and will therefore not be included in your cart. The delivery time may take a few additional days due to local declaration processes.

The United Kingdom treats all shipments as regular purchases - if there are returns of products, the recipient will be subject to customs duties and possible taxes. To read more about DETALEs delivery and return policies, please see here.

Do not hesitate to contact us at hello@detalecph.com if you need further guidance on your order.